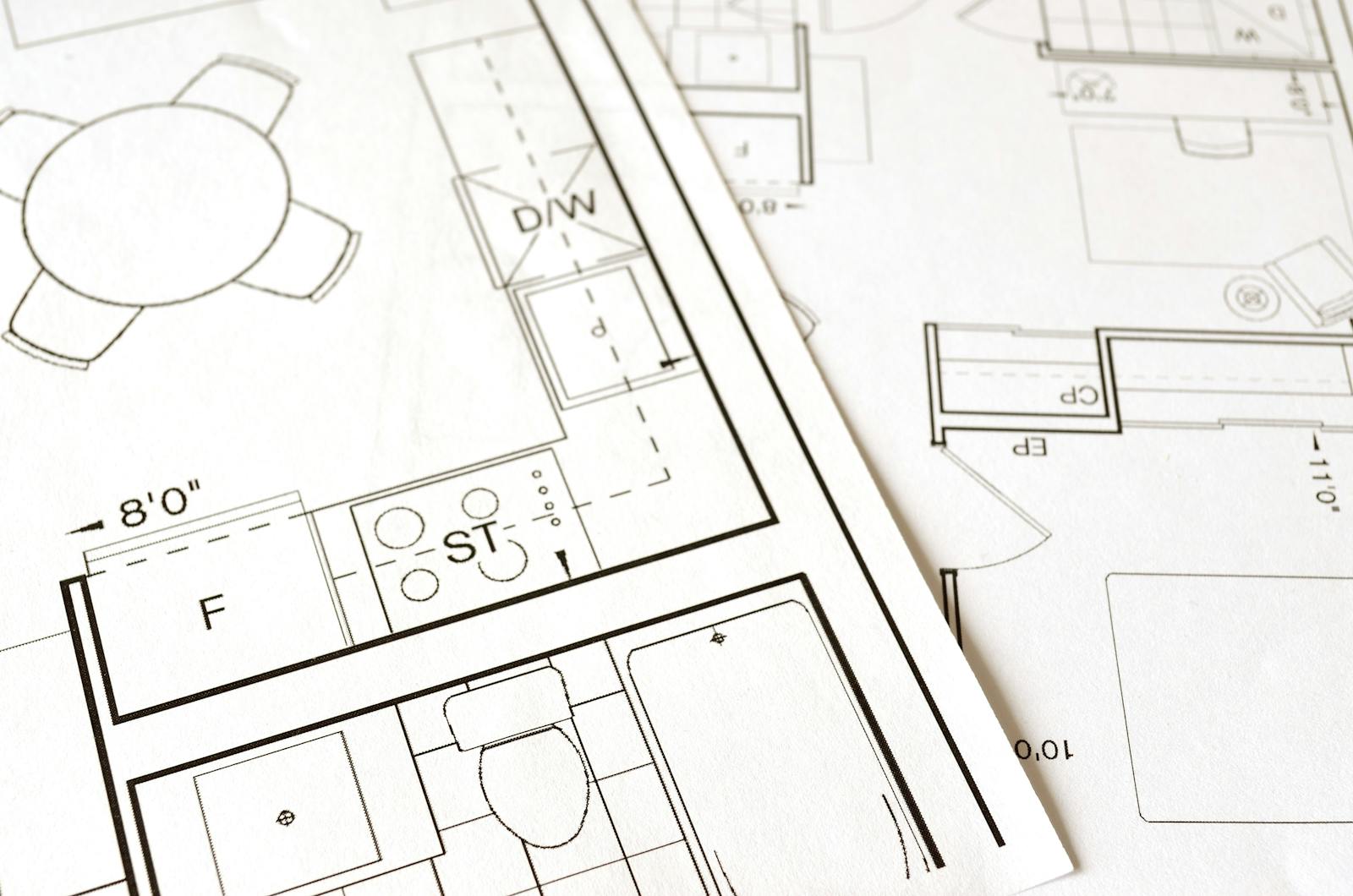

Builders Risk Insurance in Lake Worth, FL

Construction projects inherently involve many risks and exposures, as job sites typically include significant dangers, such as sharp tools, motor vehicles and heavy machinery. Furthermore, job sites may often be tempting targets for thieves and vandals, and even minor incidents could have major financial ramifications. With these things in mind, and given the stringent timelines for many projects, understanding and retaining ideal builders risk insurance is essential.

What Is Builders Risk Insurance?

A builders risk policy acts as a contract between a developer, project owner, construction firm or contractor and their respective insurer. Coverage can cultivate fiscal security and peace of mind by erecting a stout financial shield against risks and incidents that might have adverse impacts on a construction project. Whether building a new structure from the ground up or conducting renovations, builders risk coverage should be considered an integral part of adequate loss control measures.

What Do These Policies Cover?

Builders risk insurance may cover many common incidents and perils. Although exact parameters of policies may be customizable and vary by carrier, policyholders may be able to receive payouts in response to the following:

- Fires

- Vandalism

- Burglary

- Theft

- Arson

- Explosions

- Lightning

- Hail

Approved claims for the aforementioned incidents or other perils listed in a builders risk policy may help pay for losses involving the following:

- Buildings under construction

- Temporary structures (e.g., fences and scaffolding)

- Equipment

- Tools

- Supplies

- Materials

- Important documents (e.g., contracts and blueprints)

Additionally, if a covered incident causes delays and incurs additional costs, builders risk insurance may also render aid.

How Much Does Coverage Cost?

Insurers may conduct a thorough analysis of projects when providing a builders risk insurance quote. While the weight given to various criteria may vary among carriers, the following aspects of a job are often considered:

- Location

- Type of project

- Materials being used

- Number of workers on the job site

- Total project costs

- Project duration

- Coverage details (e.g., limits, endorsements and deductibles)

Get the Right Insurance

Contact United Home & Auto Insurance, LLC today to learn more about builders risk coverage or compare personalized quotes.